TAble of ContenTS

Statutory Liability For Income Tax

The Active, Controlling Treasury Decision

The Statutory Requirement To Make A Return

Cases

Brushaber v. Union Pacific R.R. Co............................................................................................. 7

Stanley v. Illinois.................................................................................................................... 6,

11

Stanton v. Baltic Mining Co....................................................................................................... 12

U.S. Department of Agriculture v. Murry.............................................................................. 6,

11

Section

Page

Statutes

§ 6001........................................................................................................................................... 8

§ 6011........................................................................................................................................... 8

§ 6012......................................................................................................................................... 19

§ 61............................................................................................................................................. 24

§ 6321........................................................................................................................................... 9

§ 6331........................................................................................................................................... 9

SEC. 22...................................................................................................................................... 26

Sec. 7203.................................................................................................................................... 10

26 C.F.R. 602.101..................................................................................................................... 21

UNITED STATES CIRCUIT COURT

FOR THE 11th CIRCUIT

|

Appellee v. Wesley

Snipes, Defendant,

Appellant |

CASE

NO.: _______ Amicus Curiae Brief On Statutory

Filing Requirements |

Amicus

Curiae Brief On

Statutory Filing Requirements

1) Defendant Snipes has been improperly and erroneously convicted of the three misdemeanor failure to file charges in the trial in the District court. The prosecution failed its duty to document for the jury during the trial, with evidence or by testimony, each and every required element of its case necessary to secure a proper conviction.

2) The prosecution cannot secure a legitimate conviction by presenting a case that does not actually document during the trial a statutory or regulatory requirement that it is alleged the defendant has failed. It is improper for the court to allow the jury to assume such required elements of the case exist in the law, when the prosecution never established such alleged requirements as legal facts during the trial.

3) An individual cannot be properly convicted of a “failure to file” charge unless the jury is actually shown the specific statutory requirements that it is alleged the Defendant has failed, together with an explanation of why and how those statutes are properly made applicable to the Defendant. Defendant Snipes has been wrongfully assumed by the jury and the court to be liable, or made liable by the statutes, for the payment of an income tax. The Defendant has also been wrongfully assumed to have failed a statutory or regulatory requirement to file a return, and specifically, to file a Form 1040.

4) No requirement to file a return, or specifically, a Form 1040, was actually identified in the statutes by the prosecution during the trial, and none can be identified in the law that would be applicable to the Defendant for the years at issue. The prosecution did not properly identify at trial for the jury any requirement that would be applicable to the Defendant to require the filing of a “return” for the years at issue, relying rather on the jury to improperly assume that such requirement must exist because the Defendant earned a lot of money. Additionally, beyond failing the requirement to identify the statute applicable to Defendant that required the filing of a return, the prosecution further never identified at trial the specific statute or regulation identifying the specific form allegedly required to satisfy the alleged filing requirement that the Defendant allegedly failed.

5) The government attorneys improperly left it to the jury to assume that liability for tax existed under the statutes, where none can be shown to exist; to assume that a return was required, where no statutory requirement can be shown to be applicable to the Defendant; and to assume that Form 1040 was the specific required “return”, when no such actual requirement applicable to Defendant Snipes can be shown in the law for the years in question, and where the law actually shows a different return as being the identified “required” return for the years in question. This conviction is therefore, improperly secured because of those erroneous assumptions that the jury was improperly allowed by the court to make, and because of the misapplication of the regulatory return requirements actually recorded in the Code of Federal Regulations.

6) The critical “link”, between the required “return” and the Form 1040, was never introduced as evidence at trial, as it was also never demonstrated during trial that Defendant Snipes is indeed even a person who is liable by statute for the payment of the income tax. These elements of the case, necessary to secure a proper conviction, were not presented as evidence during the trial and, based on the testimonial transcripts of this trial, could only have been improperly assumed by the jury to exist. Assumptions made by a jury are not a proper dejure basis upon which to found or secure a legal conviction.

Statutory Liability For Income Tax

7) The

legal requirement to file a return, it can be shown, is hinged upon the

establishment in the statutes of

liability in the individual’s name or capacity.

The only liability established for the payment of income tax in all of

the entire Subtitle A code statutes is the liability of the Withholding Agent, established in Section 1461, to pay over to the U.S. Treasury the

income tax that has been withheld from payments made to other third party

persons. Those third party persons are

those persons subject to the withholding of tax under the authorities of 26 USC

§§ 7701(a)(16), 1441, 1442, & 1443.

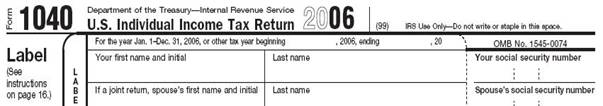

A simple reading of those statutes makes it clear the only “persons”

properly subject to the withholding of income tax under the Subtitle A statutes

are foreign “persons”.

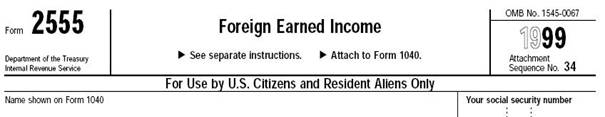

8) If the government believes that there is some

other statute anywhere in the Subtitle A Internal Revenue Code, other than

Section 1461, that establishes liability for the payment of income tax and that

would be applicable to the Defendant, then the government should identify that

statute for this court and explain how it specifically applies to the

Defendant, before this erroneous and wrongful conviction goes forward any

further in the courts.

9) There is a due process burden and requirement

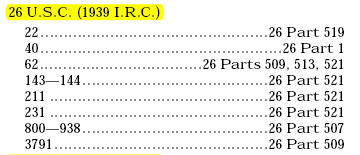

that has not been properly met by the government in the instant matter, i.e: to actually establish a statutory foundation for the

alleged liability of the Defendant being pursued in the instant matter. The government must not be allowed to equate

earnings in the name of the Defendant with liability laid in statute, in an

assumptive and presumptive manner as has occurred in the instant matter. In order to sustain the conviction in this

matter, the

10) Liability must be shown in statue, it cannot

be assumed to exist simply because an individual, the defendant in the instant

matter, can be shown to have had a large amount of earnings. The jury has been improperly led to believe

by the prosecution that they are allowed to assume that because the Defendant

earned a lot of money, he must have a liability for income tax, and therefore,

he must have a requirement to file a tax return, specifically a Form 1040. It is improper for the United States to

secure its conviction of the Defendant of these failure to file charges through

assumptions made by the jury, without actually demonstrating at trial all of

the essential elements of the case.

11) It was improper for the government attorneys

to be allowed to rely on the assumptions made by the jury about an alleged, but

unidentified, statutory liability for tax, and about any return being required

in the law, that was applicable to the Defendant for the years in

question. The jury was wrongfully

allowed, and in fact seems to have been encouraged, to make these erroneous assumptions

in rendering its verdict.

"Due

process of law implies the right of the person affected thereby to … have the

right of controverting, by proof, every material fact

which bears on the question of right in the matter involved. If

any question of fact or liability be conclusively presumed against

him, this is not due process of law." [Black's Law Dictionary 500 (6th ed. 1990);

accord,

12) In fact, none of the assumptions made by the court and the jury, regarding liability for tax and the alleged requirement to file a Form 1040 tax return, can be shown to have any support in the actual provisions of the statutes, and none of these assumptions can be sustained under the simple burden and lawful requirement to actually cite a statute that makes a person liable for the payment of a Subtitle A income tax besides Code section 26 U.S.C. § 1461.

13) The fact that the United States Justice Department is unwilling and unable to cite any code section besides Section 1461 that actually specifies that any person besides the Withholding Agent, the tax collector, is liable or made liable by statute for the payment of any Subtitle A income tax, is strong evidence that the true scheme of the income tax legislation enacted in 1913 under the “income tax provisions of the tariff act of Oct. 3, 1913”, is indeed a scheme of indirect taxation:

“…, the appellant filed his bill to enjoin the corporation from complying with

the income tax provisions of the tariff act

of

14) The indirect scheme of taxation implemented

is effected and ensured by the legislation by having the tax collectors in the form of Withholding

Agents, withhold tax from payments made to persons (subject to

withholding):

“2. The

act provides for collecting the tax at

the source; that is, makes it the

duty of corporations, etc., to retain and pay the sum of the tax …” Brushaber v. Union Pacific R.R. Co, 240 US 1, 21 (1916) (emphasis added)

15) To show that statutory liability for the payment of the income tax is indeed the controlling issue in this matter, examine the information that the I.R.S. itself is required by law to provide in its correspondence to all taxpayers. The I.R.S. is required by law to include a Notice 609 with every piece of correspondence that the government issues to an individual in pursuit of the enforcement of the tax laws;

Privacy Act and Paperwork Reduction

Act, Notice 609.

… Our legal right to ask for information is Internal

Revenue Code sections 6001, 6011, and 6012(a) and their regulations. They say that you must file a return or statement with us for any tax

you are liable for. …

16) The first code section cited, 26 U.S.C. Section 6001, clearly requires that liability for tax, or for the collection thereof, be established in order for a person to be required by this section to keep any book and records. It states;

§ 6001. Notice or regulations requiring

records, statements, and

special returns.

Every person liable for any tax imposed by this title, or for the

collection thereof, shall keep such records, render such statements, make

such returns, and comply with such rules and regulations as the Secretary may

from time to time prescribe….

17) The next cited code section in I.R.S. Notice 609, 26 U.S.C. Section 6011, also requires that before a return is required from a person, a person must be “made liable for any tax”, or liability must be identified “with respect to the collection thereof”. It states;

§ 6011. General requirement of return,

statement, or list.

(a)

General rule.

When required by regulations prescribed by the Secretary any person made

liable for any tax imposed by this title, or with respect to the

collection thereof, shall make a return or statement according to the forms

and regulations prescribed by the Secretary…

18) Liability is also required by statute in order for the United States to pursue collection by use of the lien and levy powers it is granted in statute. 26 U.S.C. § 6321 authorizes the use of the Federal lien for tax to secure property as collateral for the payment of tax due. It states;

§ 6321. Lien for taxes.

If any person liable to pay

any tax neglects or refuses to pay the same, after demand, the amount

(including any interest, additional amount, addition to tax, or assessable

penalty, together with any costs that may accrue in addition thereto) shall be

a lien in favor of the United States upon all property and rights to property,

whether real or personal, belonging to such person. …

19) And 26 U.S.C. § 6331 authorizes the power to levy property that has been seized and already has a lien for tax on it, in order to satisfy the unpaid tax liability of the person whose property is being levied. It states;

§ 6331 Levy and distraint.

(a) Authority of Secretary. If any

person liable to pay any tax neglects or refuses to pay the same within ten

days after notice and demand, it shall be lawful for the Secretary to collect

such tax … by levy upon…property…

20) And, most relevant, the language of the specific code section that Defendant Snipes has been convicted under, the code section that imposes the penalty for a failure to file a return, Section 7203 itself recognizes the requirement that a person be liable for tax by stating that it applies to any person who is “required … to pay … tax”, which is based on liability for tax, or who is “required … to make a return,”, which you must do, according to Notice 609 and Section 6011, if, again, you are liable for any tax

Sec.

7203. Willful failure to file return, supply information,

or pay tax.

Any person required

under this title to pay any estimated tax or tax, or required by this title or

by regulations made under authority thereof to make a return, keep any records,

or supply any information, who willfully fails to pay such estimated tax or

tax, make such return, keep such records, or supply such information, at the

time or times required by law or regulations, shall, in addition to other

penalties provided by law, be guilty of a misdemeanor and, upon conviction

thereof, shall be fined not more than $25,000 ($100,000 in the case of a

corporation) or imprisoned not more than 1 year, or both, together with the

costs of prosecution. In the case of any person with respect to whom there is

failure to pay any estimated tax, this section shall not apply to such person with respect to such failure

if there is no addition to tax under section 6654 or 6655 with respect to such

failure.

21) This statute addresses two groups of persons. Those who must “pay any … tax”, and those who are “required … to make a return”. The only persons required by law to “pay any … tax” are those persons made liable for the payment of the tax by statutory provision. As regards the first group of persons addressed; the only statute in Subtitle A that makes any person liable for the payment of the income tax is 26 U.S.C. § 1461, supra. Section 1461 has no demonstrated instant applicability to Defendant. As regards the second group of persons this statute addresses, Section 6011 said that it is “any person made liable for any tax”, who “shall make a return”. Defendant has no statutory liability for tax under Section 1461, or any other statute, and therefore, it follows from this statute, § 6011, that Defendant had no requirement to file a return for the years in question that he could have been properly convicted of failing. Defendant is wrongfully convicted!

22) This criminal statute, § 7203, only reaches those persons made “liable for any tax”, which must be established by and through statutory provision, not improper assumptions. Defendant Snipes has no statutory liability for any tax that can be shown to exist in his name, or that was introduced as evidence at trial. Without a showing of statutory liability in the Defendant’s name being introduced as evidence by the United States at trial, Defendant is wrongfully convicted because liability for the payment of tax has been improperly assumed, and has not been properly demonstrated under the requirements of due process.

“If any question of fact or liability be conclusively presumed against him, this is not due process of law." [Black's Law Dictionary 500 (6th ed. 1990); accord, U.S. Department of Agriculture v. Murry, 413 U.S. 508 [93 S.Ct. 2832, 37 L.Ed.2d 767] (1973); Stanley v. Illinois, 405 U.S. 645 [92 S.Ct. 1208, 31 L.Ed.2d 551] (1972)]

23) In America, under the Constitution, and under the actual provisions of the income tax tariff legislation enacted under the tariff act tested by the court in 1916 in the Brushaber and Stanton decisions, the subjects of the Subtitle A income tax are the foreign, non-resident aliens and foreign corporations deriving income from activity in the United States.

24) This is made absolutely clear by the limited authority of the Withholding Agent to withhold tax only from foreign persons. Nowhere in Subtitle A can one find the statutes authorizing the collecting of the tax at the source through a statutorily established authority to withhold income tax from payments made to America citizens. The Constitution gives the federal government jurisdiction over foreign persons in the United States by giving it control over the “naturalization” process and by prohibiting the States from entering into agreements with foreign nations. It does not give the federal government jurisdiction over the citizens on the land of the fifty states. That jurisdictional authority is left to, and is retained by, the States alone. The 16th Amendment, as stated by the Supreme Court in the Stanton decision, “conferred no new power of taxation”.

"...by the previous ruling, it

was settled that the provisions of the 16th Amendment conferred no new power

of taxation but simply

prohibited the previous complete

and plenary power of income

taxation possessed by Congress from the beginning from being taken

out of the category of indirect taxation to which it inherently belonged.." Stanton v. Baltic Mining Co., 240 US 103, 112-113 (1916) (emphasis added)

The Active, Controlling Treasury Decision

25) On March 21, 1916, shortly after the Brushaber decision was taken on January 24th, 1916, and the Opinion of the Court was delivered by Chief Justice White, the Treasury Department released Treasury Decision 2313. This un-repealed Treasury Decision is, after over 90 years, still the active standing decision of record, controlling in these Subtitle A income tax matters. It states;

T.D. 2313

“Under the decision of

the Supreme Court of the United States in the case of Brushaber v. Union Pacific Railway Co., decided January 24th,

1916, it is hereby held that income accruing to nonresident aliens in the form

of interest from the bonds and dividends on the stock of domestic corporations

is subject to the income tax imposed by the act of October 3, 1913.

Nonresident aliens are

not entitled to the specific exemption designated in paragraph C of the income

tax law, but are liable for the normal and additional tax upon the entire net

income “from all property owned, and of every business, trade, or profession

carried on in the United States,” computed upon the basis prescribed in the

law.

The responsible heads,

agents, or representatives of nonresident aliens, who are in charge of the

property owned or business carried on within the United States, shall make a

full and complete return of the income therefrom on Form 1040, revised, and

shall pay any and all tax, normal and additional, assessed upon the income

received by them in behalf of their nonresident alien principals.”

26) The first paragraph very clearly states that “income accruing to nonresident aliens in the form of interest from the bonds and dividends on the stock of domestic corporations is subject to the income tax imposed by the act of October 3, 1913.” It does not say all persons in the United States are subject. It says non-resident aliens are subject. This coincides perfectly with the lawful authority of the Withholding Agent to withhold tax in the form of a tariff from foreign “persons” as defined by 26 USC §§ 1441 & 1442, supra.

27) The second paragraph very clearly states that “Nonresident aliens…are liable for the normal and additional tax upon the entire net income “from all property owned, and of every business, trade, or profession carried on in the United States”. It does not say all persons in the United States are liable for tax on all of their business. It does not say citizens are liable for the payment of income tax on all of their business in a direct manner. It again emphasizes “Nonresident aliens ... are liable for … tax”, in perfect conjunction with what one would expect from the provisions of a tariff act.

28) The third paragraph describes the duty of the Withholding Agents and the proper original use of the Form 1040 in 1913. The Form 1040 was originally used by the Withholding Agents to report and pay tax, not on their own income, but on the income “received by them in behalf of their nonresident alien principals”.

29) Clearly, under the actual laws enacted, the Form 1040 was originally the mechanism by which the Withholding Agent turns over to the U.S. Treasury the tax that has been collected from other persons by withholding from payments made to persons subject to withholding. In doing so, the Withholding Agent is simply obeying and operating under the legislatively created duty of the Withholding Agent, identified by the Supreme Court in the Brushaber case, to “retain and pay the sum of the tax”. And the Withholding Agents today, by virtue of the statutory definition for the term, only have authority to withhold tax from foreign non-resident persons and foreign corporations, just like in 1916 when the legislation was tested by the Supreme Court.

30) These

statutes from 1913 have never been changed, and there are no intervening

Supreme Court authorities addressing these Subtitle A matters. The

31) The

government has clearly lost track of the true foreign nature of the tax that

was actually enacted by Congress in 1913, under the provisions of the Underwood

– Simmons tariff act. However, that foreign implementation is

still evident in clear and non-confusing legislation that the government either

ignores or erroneously misapplies through

a de-facto process that does not represent

a dejure application of the law and its actual provisions.

32) Form

1040 was originally to be used by Withholding Agents to report the

income of nonresident alien foreign principals. Under the actual laws enacted it was not to

be used by

33) Note that the Treasury Decision also states that it was only those non-resident aliens that were liable for the income tax on the net income from all of their trade and business in 1916. It does not say that citizens are liable for tax on the net income from all of their trade or business. It never has, and it never will, because that is unconstitutionally direct taxation.

34) Under the scheme of the tax adopted in the tariff act, the foreign “persons”, non-resident aliens and foreign corporations, are the actual taxpayers and subjects of the income tax, and the sovereign entities, the American citizens and corporations, were and are cast in the role of the sovereign tax collector, not the subject taxpayers.

35) The

only tax the citizens and

36) If the Supreme Court declared in 1896, in the Pollock v Farmer’s Loan Co. decision, that an income tax was unconstitutional when imposed directly on a citizen’s income derived from property, and if the 16th Amendment “conferred no new power of taxation” as stated in the Stanton decision, then where is the authority legitimately derived from for the Internal Revenue Service to directly tax a citizen’s income as they have been doing since the end of World War II?

37) If,

in the

38) One scheme, tested by the Court in the Pollock case in 1896, was direct and unconstitutional, the other scheme, tested by the Court in the Brushaber and Stanton decisions is indirect and entirely constitutional, as the taxing legislation does not touch the income of the citizens living and working in their respective states, it only imposes the duty on them to withhold tax from other, third party, foreign “persons” (made subject by statutory provision to the withholding of tax).

39) Since the

income tax is authorized "without apportionment", by virtue of the

wording of the 16th Amendment itself, then the income tax cannot be a direct

tax, because direct taxes must still be apportioned to the States for collection, per Article 1,

Section 2, Clause 3 of the Constitution, which has never been repealed or amended, and must be laid in

proportion to the census, per Article 1 Section 9, Clause 4, which also has

never been repealed or amended.

These Article 1 clauses remain unrepealed, are not amended by inference through the adoption of the 16th

Amendment. The income tax legislation enacted in 1913 after the passage of the 16th

Amendment is an indirect tax according to the Supreme Court in the

40) Imposts are taxes on foreign goods entering the country or on foreign activity occurring in the country, duties are taxes on activity or goods leaving the country, and excise taxes are “taxes laid upon the manufacture, sale, or consumption of commodities within the country, upon licenses to pursue certain occupations, and upon corporate privileges. Cooley, Const. Lim. 7th ed. 680”[1]. A tariff is one form of an impost, and the Brushaber court identifies the provisions of the income tax as part of a tariff act in the first sentence of the decision!

41) According to the Supreme Court, the 16th Amendment does not create a new power or authority for the government to exercise to tax directly. The 16th Amendment, according to the Supreme Court, merely prevents the income tax from being moved out of the category of indirect taxation to which it inherently belongs.

“… the provisions of the 16th

Amendment conferred no new power of taxation but simply prohibited

the previous complete and plenary power of income taxation possessed by Congress from the beginning from

being taken out of the category of indirect taxation to which it inherently belonged.." Stanton v. Baltic Mining Co., 240

42)

Clearly,

even after the passage and adoption of the 16th Amendment, the income tax legislation, that was enacted by

Congress in 1913, and that was tested and approved by the Court in 1916,

actually lays an indirect tax. It is

not the direct tax without apportionment that the government has erroneously

misrepresented it to the jury as in the instant matter in order to wrongfully

secure the conviction. Wrongfully

secured convictions based on such erroneous misrepresentations of the law to

the jury should not be sustained by the courts.

43) It was noted before that the statutes require that a “person” must be shown to be liable for tax, before he or she (or it) can be shown to be required to file a return. That is clearly demonstrated by the specific language of the statutes, which we reviewed, as well as in I.R.S. Notice 609, which stated;

Privacy Act and Paperwork Reduction

Act, Notice 609.

… Our legal right to ask for information is Internal

Revenue Code sections 6001, 6011, and 6012(a) and their regulations. They say that you must file a return or statement with us for any tax

you are liable for. …

44) We examined Section 6001 and 6011 earlier and saw how they were both contain specific language calling for the establishment and identification of liability for tax, or for the collection thereof, in order to be properly relied upon as a legitimate enforcement authority.

The Statutory Requirement To Make A Return

45) The last section mentioned in that Notice 609 is Section 6012(a), which states;

§ 6012. Persons required to make returns of

income.

(a)

General rule.

Returns with respect to income taxes under subtitle A

shall be made by the following:

(1)(A) Every

individual having for the taxable year gross income which equals or exceeds the

exemption amount, except that a return shall not be required of an

individual …

46) The underlying, but overlooked and all important question being, of course, which return is required by law to be made “with respect to income taxes under Subtitle A”? This statute, Section 6012 itself, is silent as to that specific requirement, leaving it to the reader to either, assume that Form 1040 is the lawfully required return, or to know how to personally use the law to look up that legal requirement in the law. So, what is the actual requirement proscribed in law to provide a return under Section 1, the Subtitle A code section that actually imposes the income tax, and how does an individual go about looking up and identifying in the law just exactly what Form is really required by any specific code section; - in this case Section 1?

47) The

Paperwork Reduction Act attempts to ensure that the

48) This table is incorporated into the law in the Code of Federal Regulations at 26 C.F.R. (section) 602.101, whose introduction states that the purpose of this regulatory provision is to comply with the legal requirements imposed on the government by the Paperwork Reduction Act. Although it took the I.R.S. over 5 years to comply with the mandate, the IRS itself prepared and supplied this Table to O.M.B. It states in pertinent parts;

PART 602 - OMB CONTROL NUMBERS UNDER THE PAPERWORK REDUCTION ACT

Section 602.101. OMB Control numbers.

(a) Purpose.

This part collects and displays the control numbers assigned to collections of information in Internal

Revenue Service regulations by the Office of Management and Budget (OMB) under the Paperwork Reduction Act of 1980. The

Internal Revenue Service intends that this part comply with the requirements of ... (OMB regulations implementing the Paperwork Reduction Act), for the display of

control numbers assigned by OMB to collections of information in Internal

Revenue Service regulations....

_________________________________________________

26 CFR

CFR part or section where Current

identified and

described OMB Control No.

1.1-1 ........................................... 1545-0067

1.23-5 ...........................................1545-0074

1.25-1T.........................................

1545-0922

1545-0930

1.25-2T..........................................1545-0922

49) In the portion of the table reproduced above, the left hand column shows the code section with the information return requirement. The first entry lists the code section where the income tax is imposed, i.e.; PART 1, Chapter 1, Section 1, designated here in the left hand column of the table as 1.1-1. The right hand column shows the O.M.B. Document Control Number (DCN) assigned to the information collection request, or form, that is required by the code section to satisfy its legal information return requirements. Originally, unique document control numbers were assigned by O.M.B. to all of the Forms used by the various government agencies in order to clearly and specifically keep track of all of the different information return requirements of all of the different code sections of the various Titles of the United States Code.

50) Note that in this reproduced table there is only one document control number, or form, shown here as being required by the law that imposes the income tax, Section 1, and note also that the form that is to be used to satisfy the requirements of this code section where the income tax is imposed carries the OMB Document Control Number 1545-0067.

51) Then, if Form 1040 is the proper information return (form) for United States Citizens to file to satisfy the legal Return filing requirement created by Section 1, that OMB Document Control Number - 1545-0067, will show up on the top of a Form 1040;

52) Here is the reproduced top portion of a Form 1040, and there in the upper right hand corner, it says “OMB No. 1545-0074”. That number does not match the entry shown in the table as being the correct number that is assigned to the form that is required by law by Section 1, where the tax is imposed. The Table in the Code of Federal Regulations shows that the law actually requires the form with O.M.B. Document Control Number 1545-0067, not 1545-0074, which is the number that is on the Form 1040.

53) O.M.B. Document Control Number 1545-0074 is assigned to Form 1040, but the form that is actually required by the law that imposes the income tax, Section 1, should carry Document Control Number 1545-0067. Obviously, Form 1040 is not the form listed in the law as being required to satisfy the information return requirements of the code section that imposes the income tax.

54) So what Form is assigned the OMB Document Control Number 1545-0067, and does satisfy the information return requirements of Section 1 – Income Tax – Tax Imposed?

55) Here, at the top of the form, in the upper right hand corner it says: OMB No. 1545-0067. That Document Control Number matches the entry in the C.F.R. Table for Section 1 at Section 602.101. And what is the title of this form? Form 2555 Foreign Earned Income. And what does it say underneath the title of the Form?

"For Use by

56) Form 2555 - Foreign Earned Income, states:

“For Use by

57) According

to this table in the C.F.R. for the calendar years for which Defendant Snipes

was convicted of a failure to file charge, the only income a citizen is

required to report to the government under the law is income earned in a

foreign country or in a territory or possession of the United States, which is

reported on the only form, Form 2555, that is required by law to satisfy the

statutory liability for income tax under Section 1. Income earned in a foreign country, or a

58) Section 6012(a) also referenced: “Every individual having for the taxable year gross income …”, so we also want to understand Section 61, which states;

(a) General definition. Except as otherwise provided in this subtitle,

gross income means all income from whatever

source derived, including (but not limited to) the following items:

(1)

Compensation for services, including fees,

commissions, fringe

benefits and similar items;

(2)

Gross income derived from business;

(3)

Gains derived from dealings in property;

(4)

Interest;

(5)

Rents;

(6)

Royalties;

(7)

Dividends;

(8)

Alimony and separate maintenance payments;

(9)

Annuities;

(10) Income from life insurance and endowment

contracts;

(11) Pensions;

(12) Income from discharge of

indebtedness;

(13) Distributive share of partnership

gross income;

(14) Income in respect of a decedent; and

(15) Income from an interest in an estate or trust.

(b) Cross references. For items specifically included in gross

income, see part II (sec. 71

and following). For items specifically excluded from gross income, see part III

(sec. 101

and following).

59) If we review the codified history of this piece of legislation we find a footnote that is shown in the 1954 United States Code version of the statute, stating;

"Source: Sec. 22(a), 1939 Code,

substantially unchanged"

60) This footnote was not carried forward when the law was recodified in 1986. It is not known why the footnote was dropped in 1986, but it is very important because, as you can see, the footnote identifies the statutory source and predecessor of Section 61 as being Section 22(a) in the 1939 code, the last codified version of the law previous to the 1954 version of the United States Code where this footnote is shown.

61) Section

22(a) from the 1939 code is re-printed below and it is a simple matter to see

that the language of the statute is similar to that of the 1986 version of

Section 61 that is shown above;

(a) General Definition.-"Gross Income" includes gains, profits, and

income derived from salaries, wages, or compensation for personal

service ... of whatever kind and in whatever form paid, or from professions,

vocations, trades, businesses commerce or sales, or dealings in property,

whether real or personal, growing out of the ownership or use of or interest in such property; also from

interest, rent, dividends, securities, or the transaction of

any business carried on for gain or profit, or gains or profits and income

derived from any source whatever....

62) In order to properly understand completely how Section 61 is actually applied under the law today, it is absolutely essential to know and understand how Section 22 was implemented and applied in 1939, because that implementation has been carried forward “substantially unchanged”, according to the now missing footnote.

63) The

following table, from the Code of Federal Regulations, Parts 500-599, Index of Parallel

Tables, Enabling sections from the 1939 I. R. Code. It clearly shows that Section 22 was implemented only under Title 26, Part

519;.

1991 Enabling sections

64)

The table above shows that Section 22 is

listed by the statutes as being implemented only under Title 26, Part 519.

The next table reveals what Part 519 actually is:

CHAPTER 1 - INTERNAL REVENUE SERVICE

DEPARTMENT OF THE TREASURY

(Parts 500 to 529)

__________________________________

SUBCHAPTER G - Regulations Under Tax

Conventions

Part

500 [Reserved]

501

502

503

504

505

506

507

508

[Reserved]

509

510

511

512

513

514

515

516

517

518

519

520

521

65) Part

519 was the Canadian Tax

Treaty that was signed in 1918. Section 61 actually defined the foreign sources of taxable income under the 75 year tax treaty with

66) Section

61 does not define the domestic sources of taxable

income at all according to this table, and never did. As far as citizens are concerned, Section 61 only defines the Canadian sources of

taxable, gross income under the Canadian Tax Treaty. Which agrees with everything else in the law

that we have seen regarding subtitle A income tax being a foreign tax in the

form of a tariff as identified by the Supreme Court in the Brushaber decision.

67) However,

since the Canadian Tax Treaty expired in 1993, Part 519 is now shown as reserved for

future use in this Table. Section 61 no longer has any application

at all to Canadian income because there is no longer any tax treaty between the

two nations because we have NAFTA instead.

But for 75 years from 1918, when it was first signed, to 1993 when it

expired, the 75 year tax treaty with

68) Subsequently after recodification in 1954, Section 61 (formerly Section 22) should have carried forward, “substantially unchanged” as a definition of taxable Canadian sources, the same limitation in its application as previously applied to Section 22, because the income tax law wasn’t changed, remaining an indirect (foreign) tax in the form of a tariff that is withheld at the source from subject persons, who are all foreign. Section 61 does not authorize a direct tax on a citizen’s domestic gross income at all, and careful research of Section 61 and its true legislative history confirms this fact.

69) Treasury

Decision 2313 properly stated the correct legal use of Form 1040 in 1916. It was to be used by

70) Later,

around the end of World War II, the use of the Form 1040 was altered slightly

to make it the mechanism by which any person claims a refund for overpaid tax

that had been unnecessarily withheld, but the underlying statutes imposing the

Subtitle A income tax and specifying the statutory liability for the payment of

income tax were not changed. Today, the Form 1040 is required by law to

claim a refund, but is not required by law to satisfy a citizen’s statutory

liability for tax under Section 1. Form

2555, not Form 1040, is used by “Citizens and Resident Aliens” to satisfy

statutory liability for tax under Section 1 according to the statutes and their

regulations for the year 2000. Form 1099

is, of course, now used to report to the

71) The scheme of taxation, however, for the imposition and collection of the income tax as an indirect tax with collection of the tax effected through collection at the source, accomplished through the withholding of tax from subject persons, as identified in this brief, that we have found in today’s laws, has never changed and is the same scheme for the income tax that the Supreme Court tested in 1916 and found constitutional. No other scheme of taxation was tested in those 1916 cases, or in any other case since, and the Court of course said in both cases that the income tax was Constitutional as imposed, because it is indirect (in the form of a tariff), collected and paid by third party tax collectors, the Withholding Agents.

72) Finally,

if a citizen was actually required by

any law to make a full and complete disclosure of all of his or her

financial activities on a Form 1040 return annually, and report and pay tax on

all income, and on the fruits of all of his labor, simply as a function of

having earnings, - that would not only

constitute unconstitutionally direct taxation without apportionment, which,

even after the passage of the 16th Amendment is still barred by the Constitution, but would also be direct violations of the Fourth Amendment’s

guarantee of the People’s right to be secure in their persons, papers (financial records), houses and

effects, and the 5th

Amendment’s guarantee of a protection from self-incrimination. Which is why there is no such requirement that can be shown to actually exist in the

provisions of the statutes.

Summary & Conclusion

73) The United States Courts must not allow the government to continue in its de-facto enforcement operations that are herein shown to be far removed from a legitimate and dejure application of the law. The United States Courts must not allow the government to continue to erroneously and wrongfully enforce the provisions of the income tax legislation as though it were a direct tax without apportionment, when the tax is not implemented by the actual provisions of the congressional legislation in that manner at all, and that argument was specifically rejected by the Supreme Court in its controlling decision.

74) The

United States Courts must not allow the government to continue to encourage

juries to assume that a requirement to file a Form 1040 exists, when in fact no

such filing requirement has been demonstrated, nor can be shown to exist in the

law. In the instant matter, no statutory

liability for tax that would trigger a requirement to file a Form 1040 can be

shown to exist that would be applicable to Defendant Snipes for the years in

question. Without a showing by the

government of liability founded in statute in the Defendant’s name (or capacity

as a Withholding Agent or Employer), there can be no legitimate

conviction of Defendant Snipes for a failure to file misdemeanor charges .

127) This court has a clear duty to overturn the conviction of Defendant Snipes on the three misdemeanor failure to file charges that he has been wrongfully convicted of. The government failed at trial to introduce any statute, or other testimony, as evidence that could have been relied upon by the jury to know as a proper fact of law that the Defendant was liable for tax under the provisions of the statutes, or that he was required to file any return, or that the specific return that he was allegedly required to file was in fact a Form 1040. These critical elements of the case were allowed to be assumed to exist by the jury, in violation of the due process requirements. The statutes do not support those assumptions.

128) The government failed at trial to introduce as evidence any statutory requirement applicable to Defendant to file any specific return for the year in question. This critical element of the case was also allowed to be assumed to exist by the jury, in violation of the due process requirements. Further, that Form 1040 was a specific form required by law to be filed by the Defendant, was never established by evidence at trial. This critical element of the case was also allowed by the court to be improperly assumed by the jury.

129) Unless the government establishes during the trial, by statutory or testimonial evidence, that the Defendant was actually liable by law for the payment of income tax, and was in fact required by law to file a specific form, and identifies that specific form in the law for the jury, there cannot be a legitimate conviction under a failure to file charge. Because the government has failed its burden to establish each and every required element of the case necessary to secure a legitimate conviction, this conviction must be overturned. Proper convictions are not made by persuading a jury to assume laws and requirements exist, when such claims have not been demonstrated at trial, and cannot be shown to exist in law.

130) To secure a proper conviction, these critical elements of the case must be demonstrated as evidence at trial. The Courts cannot allow the nation’s juries to assume, rightfully or wrongfully, that these critical elements of the case exist in the law if the prosecution fails to establish them through the introduction of proper evidence during the trial. Defendant Snipes is wrongfully convicted, and this court has a duty to overturn the erroneous and wrongfully secured conviction, and return these proceeding to the District court for a new trial on these charges.

Respectfully Submitted,

____________________________